With the economy in such a mess, it’s difficult not to

spend some time trying to figure out what's likly to happen in the long turm. Our current Banking

system, like most countries is based on the Fractional reserve system. This

means that if the Central Banks lends out $100,

then this can be expended into a maximum of $1,000 ($100+$90+81+$72.90+…=$1,000)

worth of loans. All these loans which the Banks lend out normaly require the lender to

add interest, so the amount the whole economy needs to pay back to the Banks ends

up being a lot more than the original $1000 borrowed.. Where does the economy

get all this extra money to pay for the interest on the loans? The answer appears to be that everyone

need to borrow more to pay for it. At lot of economist and bloggers on the web take this to mean the money supply in the US and UK has to continually increase, so should therefor cause Hyperinflation in the long run. But I doubt that will

happen for several reasons:

(1). Most Banks are private companies, only

interested in making a profit and will only lend to someone with a good credit

rating, even if it’s the Government.

(2). Both the US and UK import far more than we export, causing a flight of capital.

(3). Automation allows companies to sack more workers and keep profits / invest abroad.

(4) The effects of a stronger currency in the West is causing the offshoring and outsourcing of Jobs and in some cases companies are relocating abroad to countries like China and taking their wealth with them.

(5) Higher house prices discourage first time buyers from lending and creates an enviroment where they need to save more for a deposit.

(6) An older population is caussing more people to save for retirement.

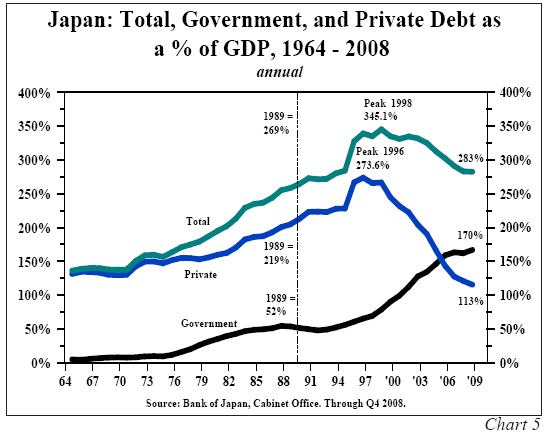

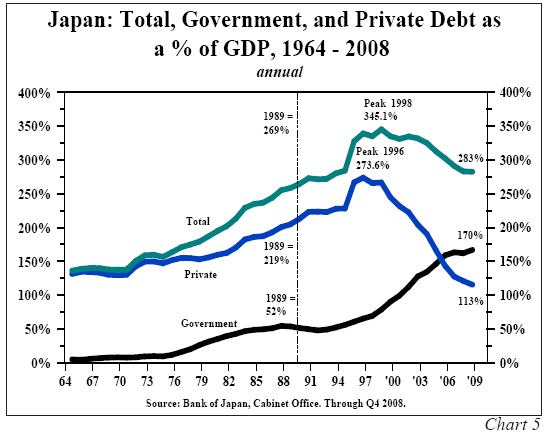

All these examples, removes money from consumers and discourages them from buying consumer goods, which makes it more difficult for companies to generate profits and pay their debts. Although these trends do not appear to have effected peoples ability to get into debt over the last 50 years, when looking at the private debt to gdp ratio, which showsnear expotential growth in debt since the 1960s. I think this was mostly unsusanable, because much of this growth was due to a declining interbank lending rate, which allowed finance companies to borrow as much as the total they had done previously, by refinancing their old debts at a lower rate.

As the interbank landing rate had now droped to zero, this processes of refiancing will no longer be an option, which means the levels of private debt should continue to fall for some time to come. This has already happened in Japan, which lowered their Interest rates to zero in 1995, around the same time the levels of Private Debt in that country peaked as the graphs below illustrate:

(2). Both the US and UK import far more than we export, causing a flight of capital.

(3). Automation allows companies to sack more workers and keep profits / invest abroad.

(4) The effects of a stronger currency in the West is causing the offshoring and outsourcing of Jobs and in some cases companies are relocating abroad to countries like China and taking their wealth with them.

(5) Higher house prices discourage first time buyers from lending and creates an enviroment where they need to save more for a deposit.

(6) An older population is caussing more people to save for retirement.

All these examples, removes money from consumers and discourages them from buying consumer goods, which makes it more difficult for companies to generate profits and pay their debts. Although these trends do not appear to have effected peoples ability to get into debt over the last 50 years, when looking at the private debt to gdp ratio, which showsnear expotential growth in debt since the 1960s. I think this was mostly unsusanable, because much of this growth was due to a declining interbank lending rate, which allowed finance companies to borrow as much as the total they had done previously, by refinancing their old debts at a lower rate.

As the interbank landing rate had now droped to zero, this processes of refiancing will no longer be an option, which means the levels of private debt should continue to fall for some time to come. This has already happened in Japan, which lowered their Interest rates to zero in 1995, around the same time the levels of Private Debt in that country peaked as the graphs below illustrate:

Although a

country with week exports like the US and UK, should in theory have a weaker currency, when a

country is in a deflationary recession like Japan and Banks have difficulty

providing loans, the supply of currency drops, which should in theory cause the currency to appreciate in value.

This effect can then feed on its self, because as a currency appreciates, imports get

cheaper and can compeat locally produced goods, increassing the flight of capital out of the country and

making it more difficult for companies to profit from their exports. This then has other knock on effects, like lower wages, jobs

losses and increased bankruptcy, which in turn reduces tax revenues for Governments

and means they too are not be able to take on more debt. Japan now appears to be

nearing the final stages of its 17 year fight with deflation, which looks like it might eventually result in the default of the goverments debt, caussing the collapse of the currency.Although Japan appears

to have gone through a very long and slow decline, dropping to third place in the list of world largest economies. This doesn’t mean the UK and

America will follow the same slow path because Japans exports have remained verry strong for past few decades and are

only now starting to approached negative numbers:

No comments:

Post a Comment